When it comes to getting a handle on your personal finances, one of the most important steps you can take is to examine your credit report. Credit reports are a detailed history of who you are as well as where you have been spending your money. The more accounts that you have open with a credit card or a lender, the more chances you have of having some sort of delinquency on your report. These accounts may be due to late payments, charge offs, repossessions or any number of other reasons. If this is the case, these issues need to be addressed in order to improve your credit scores.

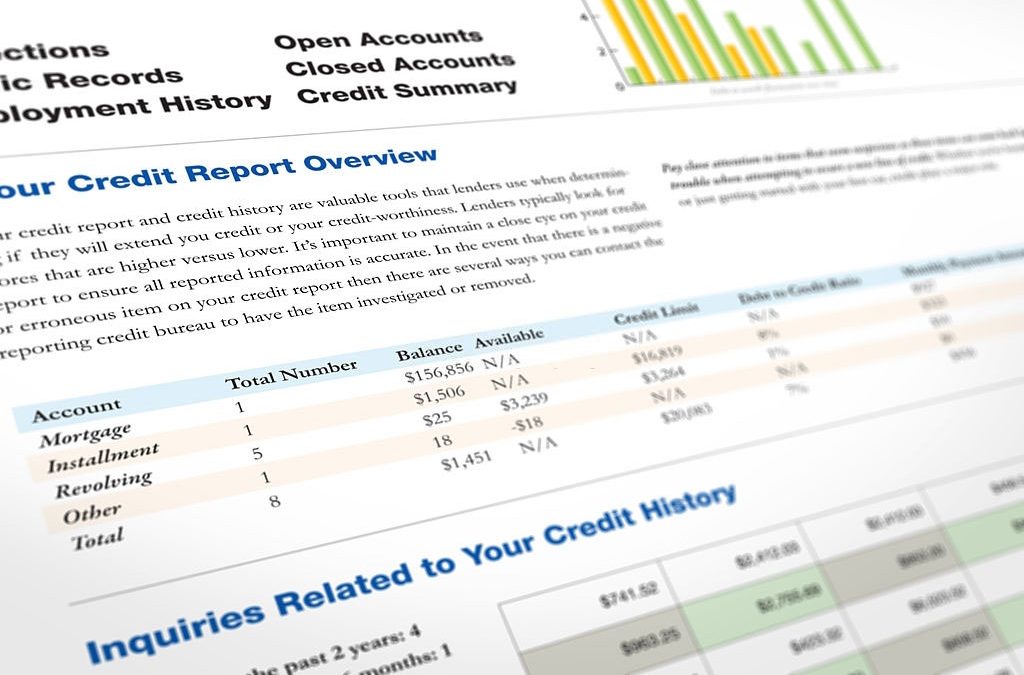

To get started, you should pull a copy of your credit report and review it for any errors. Make sure there are no errors that adversely affect your ability to qualify for credit. This first step should not be skipped as if you don’t address this issue, you will find it very difficult to ever repair these negative reports later on. Look for all the different types of reports available such as your score, consumer reports, credit-to-debt ratio and more. Learning how credit report services help you is only the first step in the process.

In order to get the most out of your credit report, you will want to look at all of the data and determine what areas need to be improved. When you pull your free annual report, you will discover a plethora of different things on your report. You need to go through this report line by line and identify areas that are hurting your chances of getting approved for home, auto, refinance, etc.

As we mentioned above, there are many different types of reports that you can access from each of the three main bureaus. Knowing which type is best for your needs will help you determine what action you need to take to improve your score. You will want to get the highest scoring BIN or report that is available to you. It is important to know that you cannot dispute items on your own. This means you must hire an agency to get your side taken care of.

The major credit reporting agencies do not operate in a transparent fashion. That is why you must work directly with the agencies in order to gain access to your credit history. Credit card companies use different credit bureaus for different debts. So if you have debt from one agency, chances are that it is being reported to another agency. Working directly with the agencies can help you find the erroneous credit information, which will allow you to file a dispute.

Many people believe the problem lies with the agencies themselves, when the problem actually lies with the credit scoring methods that they use. Some have been questioning the method known as LDLR, which stands for the low multiple entry. This scoring method was created by the three major agencies to aid the lender in determining risk. This method may be leading to more inaccurate reports than errors, due to the fact that it is being used improperly.

To fix this problem, you must go through the item yourself. Look at the dates the creditor initially placed the item, and compare them to the date you filed your claim. If there are significant differences, your score may have been affected. You can find out your score by contacting any of the agencies and getting the details of the update made. Make sure to get proof of the changes before making a final determination.

In conclusion, learning how credit report services help you can help you gain control over your finances. When you make a mistake with your loan application or your credit card application, it is not always your fault. The creditor is responsible for errors made on your account, but the scoring methods that the agencies use may cause many errors. You can find out where you stand with each agency before going to court to pursue a lawsuit. It can also save you time, money, and headaches in the future.